skip to main |

skip to sidebar

Couple of g's for the shoppin' spree.

Couple of g's for the shoppin' spree.

With today's sideways trade we don't have clarity on the longer term direction for this market. Looking at the daily chart we can go either way. Yet we had clear signals for today's trade. I was pleased to see the amount of activity in spite of the coming holiday. It should be a good week for volume with pending economic reports and global activities.

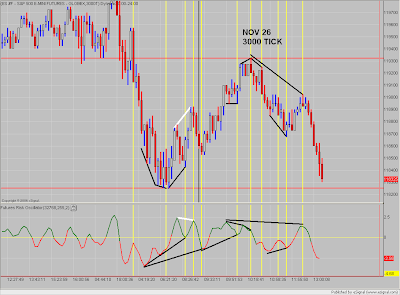

I hate it when the market party's without me! So we got less than half of the move that started just before yesterday's close. At least we had a clear entry at the open today. But if you look closely, we only had two perfect signals to deal with the pullback and the buy signal going into the close. Check the 5000 tick for the sell signal and the 8000 tick for the buy signal.